“I'm in charge here.”

Four Lessons for Business Transitions

by Stuart A. Smith III

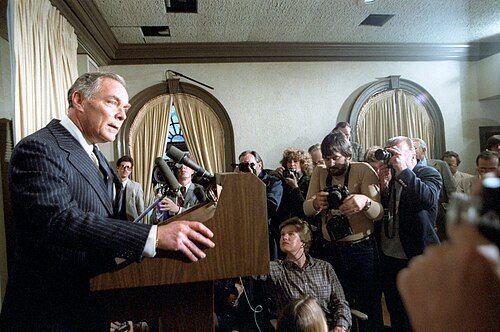

On March 30, 1981, moments after President Ronald Reagan was shot in an assassination attempt, chaos engulfed the White House. Key officials scrambled. Vice President Bush was airborne on Air Force Two. The nation wanted answers. In that frenzied moment, few seemed better positioned to take the Briefing Room podium than Secretary of State Alexander Haig.

His pedigree was beyond impressive: West Point graduate; decorated Vietnam combat veteran; graduate degrees from Columbia and Georgetown; the youngest four-star general in Army history; NATO Supreme Allied Commander; and Chief of Staff to Presidents Nixon and Ford. He was made for the moment - and responded with one of the most indelible remarks in U.S. history:

“As of now, I am in control here in the White House.”

His intent was to project calm and continuity. Instead, the remark backfired because Haig was fourth in the presidential line of succession. To many, it felt like a reflexive overreach - a raw assertion of control when trust, clarity, and coordination were paramount. Consequently, Haig is remembered not for stabilizing a moment of crisis but for adding to the uncertainty.

Over the past 32 years, I’ve worked with scores of highly successful entrepreneurs who built incredibly valuable businesses. Yet, when it came time to sell, some of those entrepreneurs had “Al Haig moments” that cratered their deals. With all that success, how could it go so wrong? In hindsight, it’s easy to see. Put simply, they reacted like Haig - trusting in résumés and past results without reading the moment.

Consequently, Haig’s misstep can teach us a great deal and, for business owners considering a sale, four key lessons stand out:

Lesson One: Facts Matter

Haig’s assertion relied on an outdated understanding of presidential succession - likely what he learned at West Point, when the Secretary of State followed the Vice President. The Presidential Succession Act of 1947 changed that, placing the Speaker of the House and President Pro Tempore of the Senate ahead of the Secretary of State. Relying on outdated facts shattered Haig’s credibility at a critical moment.

A business sale is the most detailed exercise an owner will ever face. With everything under a microscope, mastery of facts is essential. Even the best projections collapse if they aren’t grounded in verifiable fact. Blustering about “how things are” never works. If an owner is vague on facts, a buyer will assume either ignorance or indifference. Either is an irrecoverable hit to credibility.

Lesson Two: Changing the Lens

In the heat of the moment, Haig’s instinct was to step forward and lead. That instinct had been rewarded many times over in a hugely successful military career - but this wasn’t the battlefield. It was politics. A declaration unmoored from constitutional authority caused more confusion than confidence.

Like Haig, many business owners fail to recognize that they’ve entered a different arena when selling their company. The knowledge, instincts, and judgment that built the business often don’t translate well to the sale process. Fighting time-honored market customs, bristling at due diligence questions, and overriding advisors signal that an owner is stuck in their comfort zone - an operator’s mindset.

Operational know-how builds businesses.

Recognizing and honoring the rules of the process unlocks the value they’ve built.

Lesson Three: Leverage the Team

Before Haig stepped to the lectern, the Cabinet had already discussed crisis protocol, national security posture, succession logistics, and constitutional authority. Transcripts show general agreement that “the helm” - operational control - remained at the White House. To the surprise of National Security Advisor Richard Allen and Defense Secretary Caspar Weinberger, Haig’s public statement implied that he personally had the wheel. In a tense post-briefing exchange, Weinberger made two things clear: Haig misunderstood the line of succession - and better coordination could have prevented the blunder.

Business transitions are a team sport. Investment bankers, attorneys, accountants, and tax advisors each play an integrated role in getting to a successful outcome. While final authority rests with the owner, smart owners lean on the functional authority of their advisors - seasoned professionals with deeply relevant insight. In doing so, they minimize the risk of a Haig-like mistake that can shake buyer confidence and derail a deal.

Lesson Four: The Illusion of Perfect

Years of combat experience taught Haig a hard truth: no plan - and no leader - is perfect. The events of March 30, 1981, drove that point home in a deeply personal way. Despite remaining in office until June 1982 and moving on to high-profile work in business, politics, and foreign affairs, his legacy was forever defined by a single, misguided sentence from the White House podium.

In the deal of their lifetime, too many owners overlook this important lesson. They insist on perfect. I’ve seen $100 million deals fall apart over trivial points. To an outsider, it looks irrational - but entrepreneurs are often so tied to their vision of how things should work that any concession feels unacceptable. It’s a risky mindset that clouds judgment and invites self-inflicted loss. In deals, the pursuit of perfect can wreck the possible.

We should all be thankful for Al Haig’s service to our country over nearly forty years. He was a truly accomplished man with a career marked by an unbroken string of successes until March 1981. Great success emboldens leaders - whether on a battlefield, in a boardroom, or at a White House podium. It can be both a blessing and a curse.

For business owners negotiating the sale of their most valuable asset, it’s a cautionary tale. Because how they conduct themselves may shape not just the outcome… but their legacy.