The Iceberg and the Ice:

A Warning to Wealth Advisors

by Stuart A. Smith III

Ernest Hemingway said the strength of a story comes from what lies beneath the surface. A reader sees only the tipof the iceberg; the bulk that gives it weight and stability is unseen.

Business owners navigating a transition face the same dynamic. Too often, everyone — owner, family, even someadvisors — fixates on the visible milestones: the offer, the letter of intent, the closing dinner. In truth, these areonly markers along a demanding journey. What ultimately determines whether wealth is protected and value isrealized is the part beneath the surface: disciplined preparation, reliable records, repeatable processes, and a team ready to lead the business into the future.

The temptation to seek a quick exit is understandable. By the time owners decide to sell, many are fatigued andeager to move on. Wealth advisors can feel that same pull when they see meaningful AUM expansion on thehorizon. But trying to shortcut the process often leads to stalled deals, reduced valuations, or plans that collapseunder scrutiny. Advisors who recognize that risk early can protect their clients’ wealth plans by steering themtoward disciplined preparation instead of speed.

The point that discipline, not speed, determines outcomes isn’t limited to business. History offers one of the clearest examples.

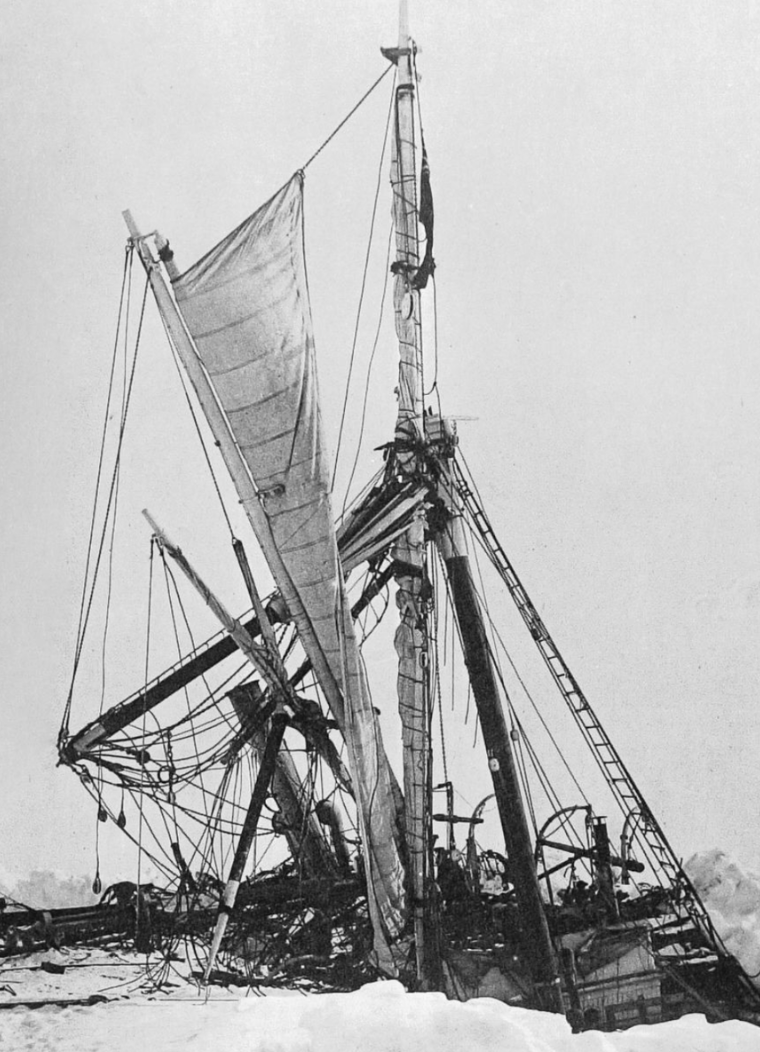

In 1914, Ernest Shackleton learned it in the most literal way when his ship, Endurance, was trapped and then crushed in the Antarctic pack ice. The bold expedition to cross the continent vanished — survival became the mission. Shackleton brought every man home because the order and routines he had built before the crisis — and insisted on during it — carried his crew through two brutal years.

The Shackleton story reminds wealth advisors that the same discipline that builds value in good times is also what preserves it when a deal hits rough ice. Wealth advisors play a pivotal role in shaping how owners approach transition. They can either reinforce focus and depth, or be swept along by the pressure to “get it done.” Discipline pays off in three essential ways.

Lesson 1 – Build the Hidden Strength

The unseen foundation of value is rarely glamorous: clean, transparent books; documented processes; a team that can keep the business running without the owner’s constant push. Owners who invest in these fundamentals frequently achieve higher exit values and enjoy stronger cash flow along the way. Those who neglect them often encounter due diligence gaps that cost them time, credibility, negotiating leverage, and often serious dollars at closing.

Wealth advisors don’t need to fix these gaps themselves, but they can insist that the work be started early so the wealth plans built around a future transaction are not undermined later.

Lesson 2 – Endure the Grind

A signed letter of intent is not the finish line; it is the point where the hardest work begins. Buyers must convince their investors and lenders that the risk of unpleasant surprises is low. That means painstaking diligence that delves into every facet of the business.

Wealth advisors who prepare clients for that reality — and keep them engaged through it — preserve momentum and value. Allowing clients to grow impatient or defensive can signal to the buyer that more risk may be hidden. That perception alone can erode price or even derail the transaction.

Lesson 3 – Lead Through Disruption

Most deals will run into a difficult patch: a wobbly market, a hesitant customer, a key employee’s uncertainty. The owner who keeps the business running well and the team steady while the deal team grinds through issues often preserves the path to closing.

Wealth advisors who focus the owner on steady leadership throughout the process protect both the client’s negotiating position and the wealth plan built around it.

Hemingway taught that what lies beneath the surface gives a story its weight — the unspoken history, the decisions, and habits that shape the outcome. In business transitions, that “beneath-the-surface” story is the discipline that builds value over years: sound systems, reliable numbers, a capable team. Shackleton’s ordeal proved that the same discipline matters most when the journey turns rough. Owners who keep that discipline, and wealth advisors who help them insist on it early and hold it steady in the crunch time of a deal, give themselves the best chance to protect value. They arrive at the closing table with both the transaction and the wealth plan intact.

© 2025 Stuart A. Smith III. All rights reserved.